17 November 2025 | Written by Mercantile Trust

Light Refurbishment vs Heavy Refurbishment: What’s the Difference?

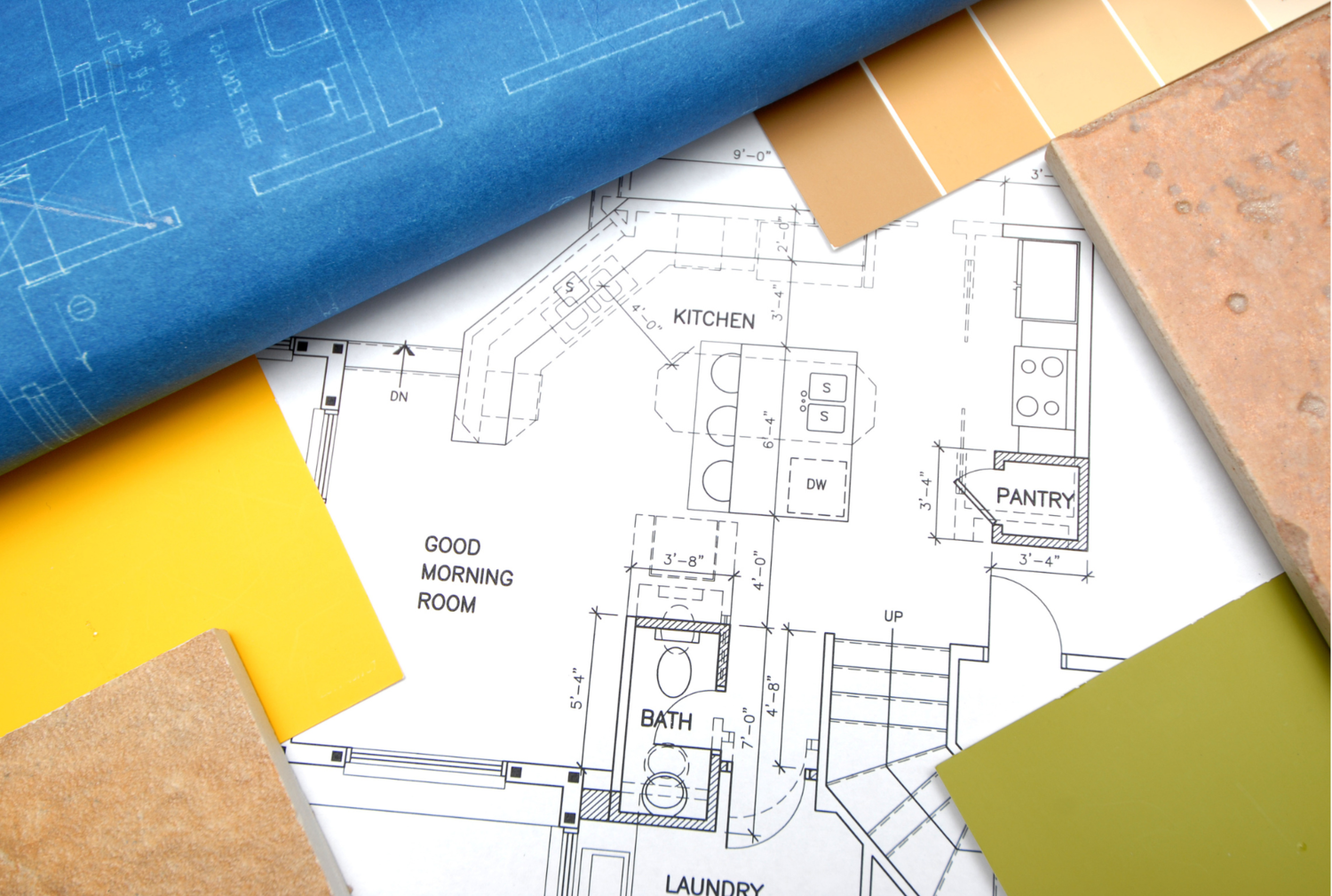

When it comes to improving a property, refurbishment projects generally fall into two categories: light refurbishment and heavy refurbishment. Understanding the difference is essential — especially if you’re financing the work through a refurbishment loan.

Below, we break down both types of projects, what they typically involve, and how they’re funded.

What Is Light Refurbishment?

Light refurbishment means making small improvements to a property without changing the building itself. It’s the kind of work that freshens up a home — like redecorating or updating old fixtures — to increase its value, attract tenants, or get it ready to sell.

A Light Refurbishment Loan is designed to help landlords and investors pay for these smaller upgrades. To qualify, the property must already be in good condition. It needs to be safe, watertight, and have working gas, electricity, and water. It also must be an existing building — not empty land or a site that needs major building work.

Typical Light Refurbishment Works

- Painting and decorating

- Replacing kitchens and bathrooms

- Laying new flooring

- Updating fixtures and fittings

- Replacing doors or windows

- Rewiring or replumbing (where no structural changes are required)

Key Characteristics

- Definition: Non-structural, cosmetic, or minor safety improvements

- Complexity: Low — usually no planning permission or building regulations needed

- Financing: Short-term (typically 1–18 months), with funds often released in full at the start

Light Refurbishment at Mercantile Trust

At Mercantile Trust, we specialise in light refurbishment lending only, offering flexible funding options designed for landlords and property investors.

Key features include:

- Loans from £25,000 to £500,000

- Up to 75% Loan-to-Value (LTV)

- Minimum property value from £75,000

- Choose to pay monthly or at the end of the loan

- No legal fees on second charges (England, Wales & Scotland)

- Adverse credit considered

What Is Heavy Refurbishment?

Heavy refurbishment means doing major work that changes the structure or layout of a building, or even what the building is used for. These types of projects are bigger, more complicated, take longer to finish, and usually need plans from professionals like architects or engineers.

Typical Heavy Refurbishment Works

- Structural alterations or extensions

- Loft conversions or major layout changes

- Converting a property from commercial to residential

- Complete "back-to-brick" renovations

Key Characteristics

- Definition: Structural, extensive, and higher-risk works

- Complexity: High — almost always requires planning permission, building regulations, and professional drawings

- Financing: Longer-term (12–24 months) with staged funding released after inspections

Side-by-Side Comparison

|

Feature |

Light Refurbishment |

Heavy Refurbishment |

|

Complexity |

Low |

High |

|

Structural Changes |

No |

Yes |

|

Planning Permission |

Often not required |

Usually required |

|

Loan Term |

1–18 months |

12–24 months |

|

Loan Release |

Typically upfront |

Staged drawdowns |

|

Risk Level |

Lower |

Higher |

Frequently asked questions:

1. What’s the difference between light and heavy refurbishment?

Light refurbishment covers cosmetic or minor updates that don’t change the building’s structure — like decorating, replacing a kitchen, or laying new flooring.

Heavy refurbishment includes structural or major work, such as extensions, loft conversions, or changing the layout of the property.

2. What counts as light refurbishment?

Upgrades like:

- Painting

- New kitchens or bathrooms

- Flooring

- Windows and doors

- Rewiring or replumbing (no structural changes)

3. Do I need planning permission for light refurbishment?

Usually no. Most light refurbishment jobs don’t require planning permission.

4. Do you offer heavy refurbishment loans?

No — at Mercantile Trust, we only offer light refurbishment loans.

Need funds fast?

We can help you access short-term finance quickly and easily.

Contact us today to discuss your plans.